how fast does an auto loan build credit

HVCUs low rates and flexible terms help to keep your payment affordable. An auto loan from InTouch Credit Union is a fast and convenient way to lock in an affordable payment.

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Credit Score Credit Repair Companies

Here are some tips to consider if you need a credit builder.

. If you have a five-year car loan for example the loan will affect your credit for a total of 15 years. Read Expert Reviews Compare The Best Vehicle Loans Options. Refinancing a car has a.

Buying a car does help your credit but never buy a car just to raise your credit. Click Now Apply Online. Dont let a car dealership rope you into one of their financing deals they usually come out more expensive and with higher APR.

When you take out an auto loan especially a bad credit car loan you gain the opportunity to make a positive. A car loan by itself wont always build credit. Therefore youre going to want to plan out your purchase to make sure you dont overextend yourself and your payments fit well within your budget.

This is a low-effort strategy that can quickly improve your credit score. Getting a new car loan has two predictable effects on your credit. The biggest piece of the pie is payment history making up 35 percent of your credit score.

The main reason a car loan is a good way to build and improve your credit score is because as you make payments on time you begin to build a positive payment history. The benefits over time of an auto loan will improve your credit outlast the negative impact and will show potential lenders that you are a 9. Contact your credit card company and ask for a higher credit limit.

In fact Experian mentions that once you take on a car loan your credit might actually experience an initial decrease. Your credit utilization refers to the amount of your available credit line that has a balance. The impacts of a car loan start with the first inquiry on your credit score.

Ad Vehicle Loans As Low As 199 APR¹ and no payments for 90 days². First it will increase your total debt load and change your credit utilization ratio which may cause a slight drop in your score. In addition to rebuilding your credit score an auto loan can also help you build a positive credit history.

Compare Rates Save Money. Yes car loans help build credit. The car loan remains on your credit for the life of the loan plus another 10 years.

Building Positive Payment History. It will take about six months of credit activity to establish enough history for a FICO credit score. In short buying a car can be a good way to build your credit score over the life of the loan but its more of a long-term credit building strategy.

Payment history makes up 35 percent of your FICO credit score which is the score most commonly used by lenders. How Fast Can a Car Loan Raise Your Credit Score. Buying a new car.

Good credit history is essential for getting approved for future loans and mortgages so it is important to start building one as early as possible. By focusing on your credit card alone you can build excellent credit. If you already have a credit score in the 800s and you make payments on a car loan it wont increase much because the highest score is 850.

It adds a hard inquiry to your credit report which might temporarily shave a few points off your score. But if you have a low credit score like in the 400s making regular and on-time payments can raise your credit score considerably over the long term. Op 7 yr.

Depending on how these factors add up your credit score can rise and fall as your credit situation changes. Car loans help or hurt your credit. In this article Im going to explain the five factors that comprise your credit score and show you how 90 percent of your score is comprised of factors that DONT rely on an auto loan.

So if your credit limit is 10000 and you have a balance of 5000 your credit utilization is 50. One of the key ways to build wealth fast and over the long term is to earn. But if you keep up with your monthly payments an auto loan can definitely help you improve your credit over time.

To build a credit score from scratch you first need to use credit such as by opening and using a credit card or paying back a loan. Because car loans and other borrowing stays on your credit report for so long its important to pay on time every month. Ad The Comfort Of a Simple Vehicle Loans Is Priceless.

After you complete a car loan you may not see a boost in your credit score it may actually be the opposite. October 10 2018. You should go into the lot with a bank or credit union financing already.

Click See More for Advertiser DisclosureYou can support our channel by choosing your next credit card via one of the. 7 Steps I Used to Raise My Credit Score by 134 Points in a Year The process of raising my credit score well over 100 points can be the first thing I did was examine my credit cards auto loan 9. A car loan in and of itself does not build credit.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. In this article well answer the question Does financing a car build credit and provide some additional. Getting a car loan to improve your credit score is a waste of time and money.

These offers do not represent all available deposit investment loan or credit products. Buying a car does help your credit but never buy a car just to raise your credit. Auto financing also adds to your credit mix and new credit.

A car loan can raise your credit score but its a slow build accomplished through months and years of on-time payments while keeping up with your other bills.

How Low Of A Credit Score To Get A Car Improve Credit Improve Credit Score Good Credit Score

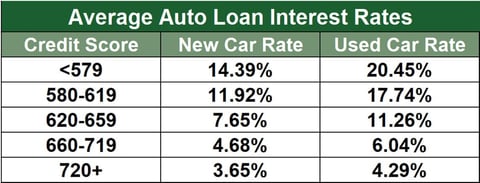

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Consolidate Credit Card Debt Credit Score

Free Car Loan Application Form Car Loans Bad Credit Score Car Finance

Free Car Loan Application Form Bad Credit Car Loan Best Payday Loans Payday Loans

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

Auto Car Loans For Bad Credit Auto Finance With Bad Credit How To Get Bad Credit Auto Loan Loans For Bad Credit Bad Credit Car Loan Good Credit

Get Guaranteed Approval Auto Loan For People With Bad Credit At Lowest Interest And Affordable Monthly Payment Car Loans Loans For Bad Credit Loan

Increase Your Credit Score By As Much As 18 Points In One Day Credit Repair Credit Score Improve Credit Score

Pin By Chelsea On Business Tips Ideas And Dos In 2022 Money Management Advice Small Business Advice Business Checklist

Tumblr Bad Credit Score Payday Loans Loans For Bad Credit

Award Winning Credit Union Advertising Marketing Case Study Mdg Advertising Banks Ads Car Loans Car Loan Ad

Follow Financialfitclub Credit Creditrepair Creditscore Creditrestoration Financialfreedom Debt Realestate D Credit Repair Credit Education Tradelines

Pin By Loan Buddies On Loans Loan Types Of Loans Document Sharing

Does Financing A Car Build Credit

Credit To Qualify For An Auto Loan And Tips For Car Credit Car Lease Credit Cars Car Loans

What Credit Score Is Needed To Buy A Car Lendingtree

Becoming Her On Instagram Cash Is King And Credit Is Power You Could Be Leaving So Much On The Table Good Credit Credit Repair Services How To Fix Credit

We Ve Got Auto Loans Just For You In 2020 Car Loans Car Finance Loan